Here’s my take on Universal Basic Income and why we should fight for Universal Services instead. It’s based on a comment in a public forum. I may write a proper blogpost on the topic, supplying sources and figures.

I think the debate around UBI is important for the future of the working-class movement. I’m a socialist and it’s something that I take seriously. I think our understanding of UBI has to be linked to the nature of the Canadian state. Its history illuminates its essentially capitalist character; so I’ll start there. Here’s how I understand the problem:

- The British state had a hard time getting capitalists to invest “surplus capital” in Canada in the nineteenth century because there was no stable supply of labour power. The labour market was only fully developed around 1850, and unevenly across the soon-to-be country.

- A labour market was established by restricting access to the land, both for Indigenous peoples and for would-be farmers that came from Europe and elsewhere. Colonial policy was designed to make sure there would be a supply of workers for capitalists. By restricting access to the land, would-be farmers were forced to work for a capitalist for a wage. I think this — plus a heavy dose of racism — is behind the genocide of Indigenous peoples and the residential schools system. Traditional indigenous ways of life are incompatible with capitalism because they have a different relation to the land. Clearing the land also made access to its resources possible. This casts a different light on the Canadian state’s monopoly of Crown Lands and helps disabuse us of the idea that it’s holding them in trust for the Canadian public at large. To the contrary, it is a means to control working people and a gift to business enterprise.

- The idea of restricting access to the land to create a working class was developed by E.G. Wakefield in “A Letter from Sydney” and is sometimes called the New South Wales system (because the policy was also applied to other British colonies). Basically, the state would set the price of land too high for workers to be able to afford it. This is his theory of the “sufficient price.” His theory had an overpowering influence on British colonial policy. This way, instead of independent farming, people would be forced to join the working class. It was debated in British Parliament and enacted in the “An Act for the disposal of Public Lands” in 1841.

- The creation of a working class in Canada was a deliberate policy of the British state, as a capitalist state. The Canadian labour market is based on restricting access to the means of production (and therefore means of subsistence). This is similar to the enclosure movement in England, which accomplished the same thing: the creation of a working class divorced from the land.

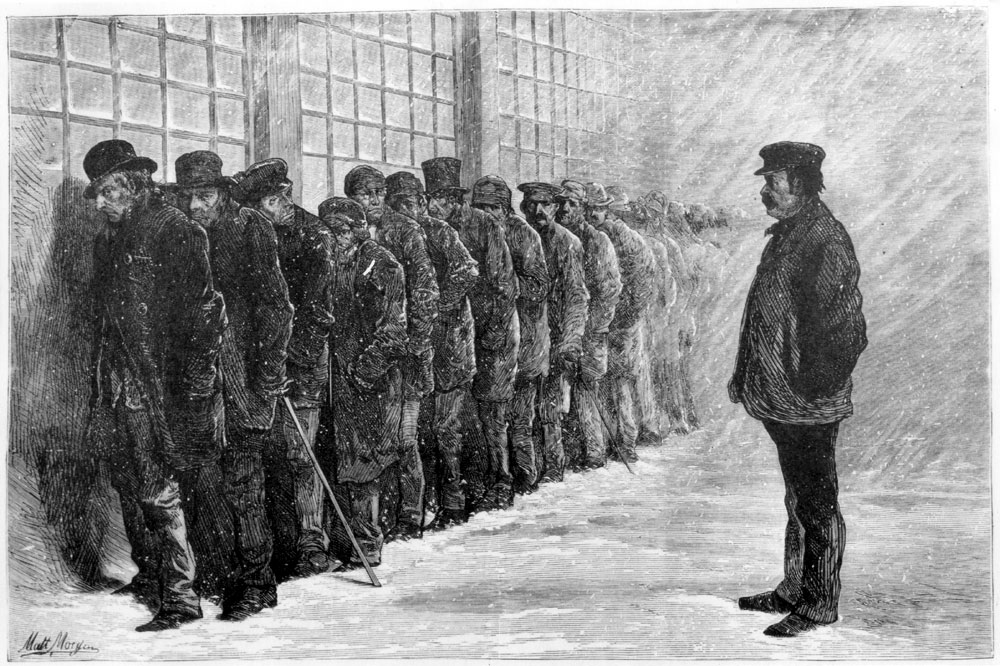

- The Canadian state continues to restrict access to the means of subsistence to ensure compliant workers. State supports for the poor and unemployed are deliberately designed to spur people into alienating work. They have never risen above the standards of the English Poor Laws. Over the last decades, social supports have gotten worse. They have been reduced to push more and more people into crumby, poorly paid jobs to make ends meet. The reasons for this are the subject of another conversation, I think, but I believe Canadian capitalism increasingly needs to keep wages low and workers compliant. We know it as neoliberal policy, but I think the policy is being driven by an economic need to improve profitability. In any case, the point is that restricting access to resources is built into the way the Canadian state works as a capitalist state. It is an essential, inalienable aspect of the Canadian state.

- The capitalist class and the Canadian state want to erode social supports for workers and privatize public services. On the one hand, by eroding social supports, they want ensure workers accept low wages and crumby work. On the other hand, by privatizing public services, they want to create new spaces for profitable investment. They want to increase dependence on the market for goods and services to boost profitability and investment.

- Universal Basic Income was promoted by the right-wing neoliberal economist, Milton Friedman; the same man responsible for neoliberal “economic reforms” in Chile after Allende was deposed by the right-wing fascistic Pinochet. Why would he support UBI? So people spend on private services, while cutting public services.

- The Canadian state will always seek to improve the profitability of the system. It’s baked into the cake and an unavoidable aspect of its being a capitalist state. Economic growth depends upon it. Therefore, it will never raise social supports to such a level that it would undermine the coercive integrity of the labour market. In other words, the Canadian state can only tolerate a certain level of social services. It will never give workers enough so they can avoid work and live in dignity. Workers need to be economically coerced into alienating capitalist work.

- Therefore, I think that UBI — if it is administered by the Canadian state — will not be added to existing social services, but will come at their expense. Furthermore, by privatizing public services, it will worsen the conditions of work for those who deliver the services and will be subject to the same competitive pressures and crisis tendencies of capitalism as a system. Unless we control the process democratically through independent working-class organizations, this will be the result. We are not right now able to administer such a system democratically, because the working class is “on its heels,” so to speak, and the state has exerted itself considerably to disorganize us. Is it any wonder that advanced capitalist states around the world want to adopt it, even though the working class is not yet strong enough to push for it?

- We need a demand that we can rally around that will break the logic of capitalism and unite public- and private-sector workers. For this reason, I think Universal Services democratically managed by workers for workers could be an answer. I think we can think of it as topping off existing public services with the money that would be put towards UBI. The ruling class will never go for it, but I think working people will go for it, and that provides a foundation for struggle. It is a reasonable demand; and if capitalism cannot provide it, then it requires breaking with capitalism.

I believe state-administered UBI is 1) a trojan horse for more neoliberal policies and 2) a red-herring, because it diverts our attention and energies into something that will make things worse.